If you are a small business owner, the ever-present challenge of mitigating cyber risks is likely at the forefront of your mind. One effective strategy to protect your business is through data breach insurance.

Cybercriminals are increasingly targeting the customer information that today’s businesses hold, including sensitive data like social security numbers and credit card details.

This is not merely a hypothetical threat but a grim reality that an increasing number of small businesses face, as evidenced by the growing incidents observed by managed service providers.

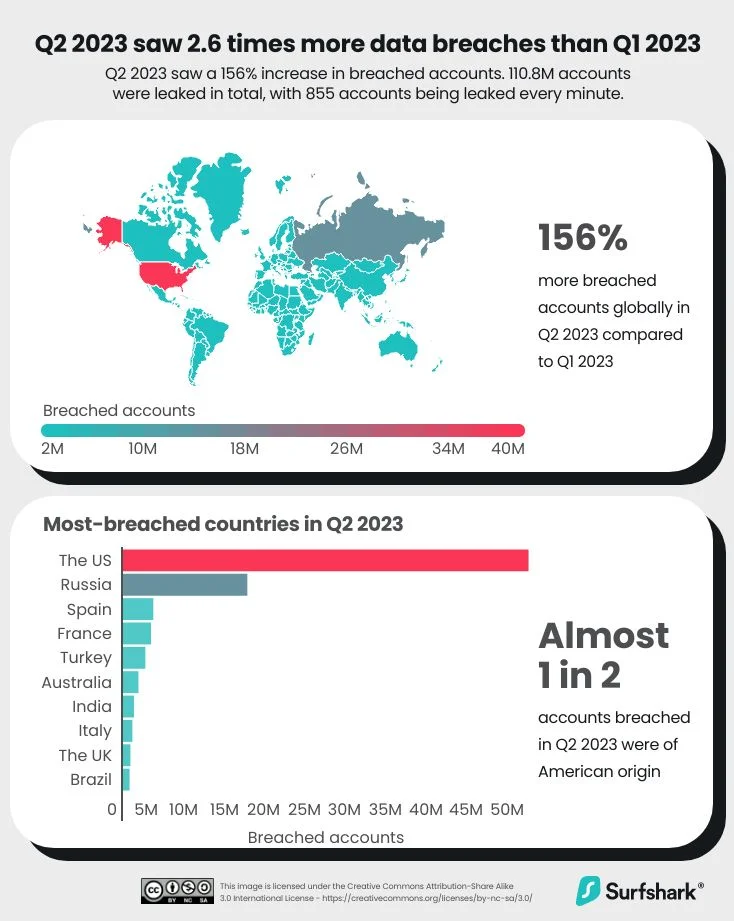

A study conducted by Surfshark revealed a staggering 31.5 million accounts were compromised in the third quarter of 2023 alone, with the United States witnessing the highest number of security breaches, representing about a quarter of the global total.

“Having a data breach insurance policy is more than just a good idea; it’s a necessity,” says Kevin Derenard, CEO of KDIT. “It acts as a blanket of security for your business.”

In this article, we will explore the nuances of data breach insurance, highlighting its growing role in safeguarding businesses against the evolving cyber risk landscape. We’ll discuss what data breach insurance entails, its protections, and its significance as a core component of a comprehensive digital defense strategy.

Demystify Cyber Data Breach Insurance With Help From Our Experts

Get all the details about cyber liability coverage by partnering with KDIT.

Learn More

What Constitutes a Data Breach?

At its core, a data breach represents a security incident in which confidential, sensitive, or otherwise protected customer information is exposed or accessed without proper authorization.

This covers a wide array of personal data, ranging from social security numbers and credit card information to health records.

The causes of data breaches can vary significantly, and often include:

- Inadvertent disclosure or leakage of data

- Improper handling or management of data

- Human error, including mistakes made by employees

- Targeted cyberattacks, such as DDoS or ransomware attacks

The repercussions of a data breach are far-reaching, often resulting in the erosion of customer trust, substantial financial losses, and possible legal fees and penalties.

Security breaches harm a business’s immediate operational capacity and long-term reputation and relationship with clients, underscoring the need for robust cyber data breach insurance as a critical safeguard.

Source: Surfshark

What is Data Breach Insurance?

Data breach insurance, often called cyber data breach insurance, is a tailored insurance solution for businesses. Its primary role is to assist companies in managing the risks associated with data breaches and alleviating the financial strain they can cause.

This type of insurance generally covers expenses related to breach response efforts. This includes services like credit monitoring for individuals impacted by the breach, public relations campaigns to mitigate reputational damage, legal fees, and settlements for regulatory fines or penalties levied in the aftermath of the breach.

Opting for data breach insurance is a strategic defense mechanism for businesses, equipping them to handle the financial repercussions of cyber incidents effectively.

It’s an essential component of a comprehensive risk management strategy, aiming to protect your business from the severe consequences that a breach could entail.

Why Having Insurance Against Data Breaches is Crucial for Business Owners

In a time where every online interaction, from a simple click to complex digital transactions, can be a gateway for cyber risks, insurance against data breaches emerges as an indispensable safeguard for businesses.

For Managed Service Providers (MSPs), while threat detection and prevention are critical, data breach insurance provides an essential layer of protection against evolving attacks and attack methods.

However, despite rigorous security measures, cyber-attacks and security breaches require time to be addressed effectively.

Recent studies indicate that the global average time to detect and neutralize a data breach is an alarming 277 days—or nearly nine months—with the phase dedicated to containment averaging 70 days.

When a breach occurs, this form of insurance becomes an immediate source of financial relief, empowering businesses to recover with unprecedented speed and flexibility.

However, its value transcends financial aid; it stands as a commitment to customers and clients, ensuring that their customer information and interests remain safeguarded in the face of adversity.

Choosing to invest in data breach insurance is not just a protective measure for the present. It signifies a business’s forward-thinking attitude and dedication to cyber liability coverage, reinforcing a strong message about its commitment to data security and the protection of customer information.

What Does Data Breach Insurance Cover?

Data breach insurance coverage is comprehensive, addressing both first-party and third-party liabilities. Let’s dive into the specifics of what these entail:

First-Party Coverage

Notification Costs: Addresses expenses for legally mandated notifications to affected parties, covering diverse communication methods like mail, phone, or digital.

Public Relations: Allocates funds for PR campaigns aimed at reputation management and trust restoration post-breach, which is pivotal for preserving customer confidence and the business’s public image.

Business Interruption: Provides compensation for lost revenue when operations are disrupted due to a breach, ensuring financial stability during the recovery period.

Digital Data Restoration: This covers the cost of recovering or replacing lost or stolen or corrupted digital information, which is crucial for digitally dependent businesses.

Cyber Extortion: Supports negotiations and payments in scenarios like ransomware, safeguarding against the financial impacts of cyber threats.

Crisis Management: Allocates funds for hiring specialists, including consultants and legal advisors with cyber incident expertise, to manage the aftermath of a breach.

Forensic Analysis: Finances investigations to uncover the breach’s cause and scope, aiding in future incident prevention.

| More articles you might like: |

Third-Party Liability

Defense Costs: It covers legal defense expenses if litigation ensues from a data breach, which is vital for managing costly legal challenges.

Settlements and Judgments: Handles court-mandated compensations or settlements, protecting from the financial strain of legal judgments.

Regulatory Compliance Fines: Assists in covering regulatory fines and penalties for failing to comply with data protection laws, crucial for businesses under tight regulatory scrutiny.

Network Security Liability: Offers protection against claims stemming from network security failures, critical for reducing legal exposure related to cyber vulnerabilities.

Media Liability: Addresses claims involving defamation, libel, or intellectual property infringement during a breach, significant for entities with substantial media interactions.

Credit Monitoring and Identity Theft Protection: Provides services for affected individuals to monitor and guard against identity theft, essential for maintaining customer trust and protection after a breach.

Answers to Common Questions About Data Breach Insurance

| Question | Answer |

| 1. Are data breach insurance and general liability insurance the same? | No. General liability insurance typically does not encompass cyber incidents.

Data breach insurance is tailor-made to navigate the intricate landscape of data breaches and cyberattacks, offering specific protections that general policies lack. |

| 2. How are the costs of data breach coverage determined? | Several variables influence the pricing of data breach insurance.

Key considerations include the nature of the business, the volume of sensitive data managed, and the robustness of your business’s cybersecurity measures. These elements collectively help insurers assess the level of risk and, consequently, the insurance premium. |

| 3. Does data breach insurance cover ransomware attacks? | Absolutely. Numerous policies provide specific inclusion for ransomware attacks, addressing the financial implications of these increasingly prevalent cyber risks.

This coverage is vital in offering financial relief and support during security crises. |

| 4. Can data breach insurance help enhance my business’s cybersecurity measures after an incident? | Yes. Data breach insurance plays a pivotal role not just in mitigating immediate financial distress following data loss or a security breach and bolstering your cybersecurity framework thereafter.

Insurers often extend additional resources and guidance to enhance cyber defenses, thus contributing to a stronger, more resilient cybersecurity posture for businesses moving forward. |

Find the Perfect Data Breach Insurance Policy With KDIT’s Expertise

Data breach insurance can act as a critical safety net in the wake of a data security incident, yet selecting the most appropriate policy requires insight into both its advantages and potential drawbacks.

A common hurdle for many businesses is the misconception that data breach insurance is prohibitively expensive, leading to postponement in acquisition until a breach occurs. This often resulted in far greater expenses and operational disruptions.

| Trusted Cybersecurity Services Near You

|

||

Don’t get trapped in this predicament. Work with a knowledgeable specialist at KDIT for tailored advice on data breach insurance policies that align seamlessly with your business’s requirements, empowering you to make an informed decision.

For comprehensive guidance on securing a cyber data breach insurance policy that addresses your specific needs, contact us today to schedule a free consultation. Take a proactive step towards reinforcing your business’s defense against cyber risks and security breaches.